Which Is the Best Fixed Deposit Scheme in India?

Fixed Deposits are one of the more common and preferable investment schemes in India. Investors should be aware of the benefits one gets from Fixed Deposits before he or she decides to put money into it. Bank FD rates are risk-free and bring guaranteed high returns to the investor. The advantages of Fixed Deposit depend on the amount deposited, deposit tenure, and type of depositor.

There are certain things that should be noted while finding the best banks for Fixed Deposits:

FD rates

The FD rates are the main focus of any investor, and high FD rates can result in high returns. It depends on the interest paid on the deposited amount which will remain constant until the period of FD is decided by the investor.

The earlier people start investing money in Fixed Deposits, the more they can leverage the benefits of saving money and multiplying it with time. Pixabay

Deposit Tenure

The interest rate varies with the tenure of the amount deposited in FDs. Generally, the longer the tenure, the higher will be interest on the fixed deposited amount. The tenure can vary from a few days to years.

The credibility of the Bank

The trust that brings the investors to the banks might vary for different banks. The customers must make sure that the banks are certified by ICRA or CRISIL. Some banks may not provide services as expected by the investors and deny the task at a crucial time.

Payout

The customer reaching out to the bank must be aware of all the policies related to the Fixed Deposits and interest they will get based on their tenure and deposited amount. The banks that you choose must deliver the highest interest on the amount you give to them.

Withdrawal

The penalty charge is in case the depositor unlocks the FD before its tenure. In some cases, the bank can provide services where there is no lock-in period or less penalty for the customer. These types of banks believe in making a bond with their customers and providing good facilities to them.

Lock-In Period

Most of the banks have a lock-in period where investors are not allowed to withdraw the money deposited in FD. Some banks restrict load from premature FD in case of emergency too.

Transferable Account

Certified banks provide a facility wherein an investor can transfer his or her account to different branches of the same bank.

Tax Deducted at Source

The tax bracket of the investor must be sorted and levied on the interests that are provided on the Fixed Deposits. TDS is applicable even on Fixed Deposits investments.

Additional Benefits

Some banks provide additional benefits for senior citizens opting for Fixed Deposit. They also provide some beneficial profits in loans for investors with FDs of higher amounts. Some banks and financial companies even allow you to check the status of your Fixed Deposits online.

Fixed Deposits are one of the more common and preferable investment schemes in India. Pixabay

Figuring out the best banks for FD investments where money multiplies with time and provides interest rates that are lucrative. The safest way of investment helps in growing the amount of savings and also provides flexibility with high stability. People can choose the period of deposit varying from 12 months to 60 months.

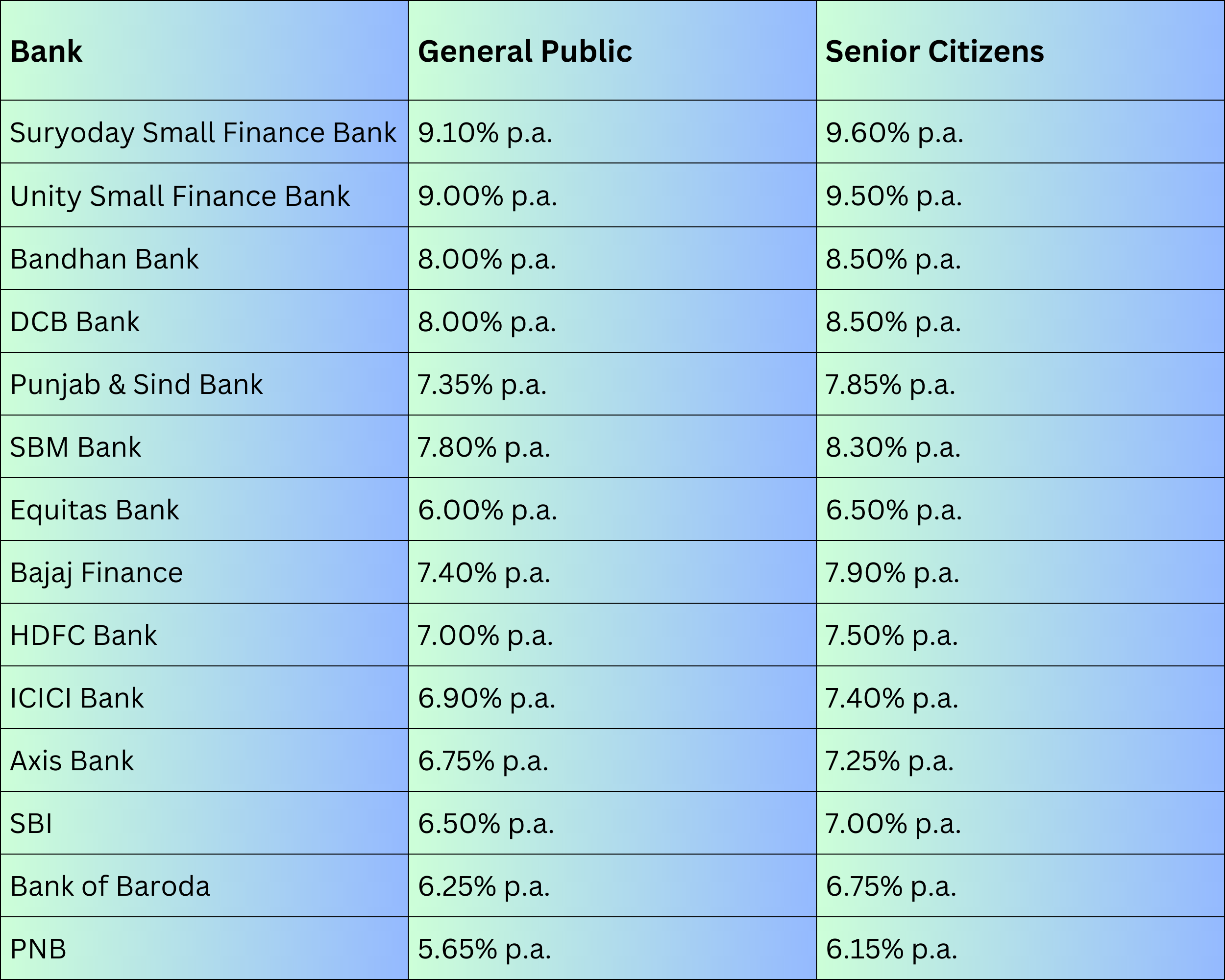

The investments made in FD at a young age are the best part of savings. These savings don’t get affected by any curriculum introduced in the banks. While your returns remain stable, you also stand to get a stable income at the end of the tenure without affecting your savings too much. For some cases, you can look into some of the Best FD rates of top Banks:

The variable period of investments is what matters to many people, where Fixed Deposits help the investor to decide the lock-in period and the amount. It makes sure that the customer receives all the services expected from the bank. The young generation can invest in such schemes for their elders and support them in crisis, as there is no fluctuation in the return money due to the market, which changes very often. Some Fixed Deposits cannot be easily molded as per the customer’s requirement, they may stick to the rules and laws made by the higher authorities. For checking out some of the benefits and features you might want to visit here. The earlier people start investing money in Fixed Deposits, the more they can leverage the benefits of saving money and multiplying it with time.

Appreciate the creator