How to Screen Tenants for a Rental Property?

Are you a landlord, homeowner, or investor who gives their property for rent? This blog can help you a lot in terms of finding just the right tenants. Tenants can be a headache, and they can be very nice too (the type we call quality tenants).

Of course, you are looking for quality tenants to give your Ajman freehold property on rent. How to do that? Implement an extensive and uniform screening process when meeting prospective renters.

Many landlords face challenges like non-payments, late payments, property damage, or tenant eviction. To save yourself from any unpleasant situation, screen all your tenants before signing the contract.

But how can you check the history of a tenant, whether they have a criminal record or not, and other things? These are probably the questions that have led you to this piece, especially if you are a new property owner.

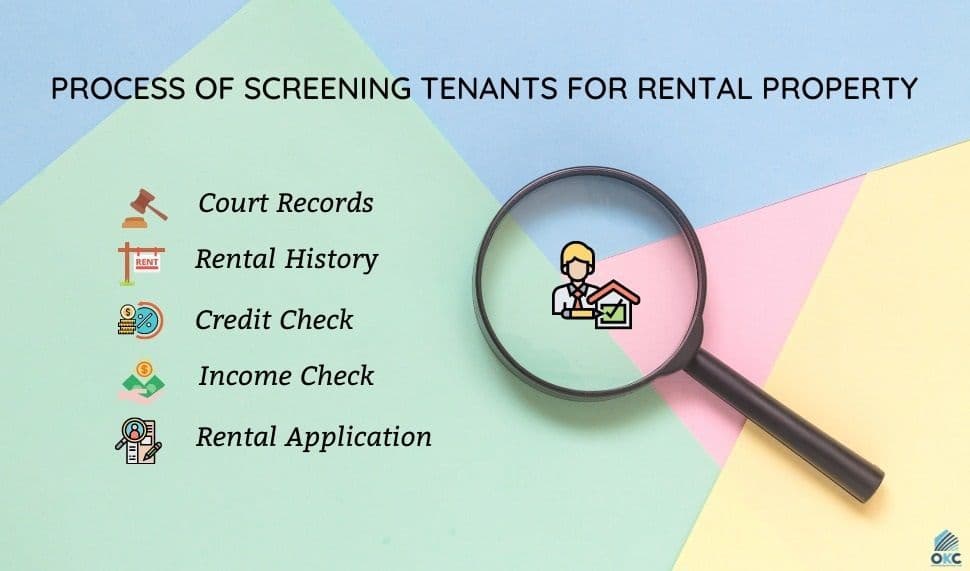

Here are some pieces of advice on how you can screen tenants to ensure you get the harmless ones.

How to Screen Tenants for A Rental Property

1- Conduct A Background Check & Credit Report

Check each candidate for tenancy for criminal backgrounds and credit reports. If there is a problem with a tenant, you can most likely find it through these most reliable methods of tenant screening.

Ask the prospect to bring a credit report issued by Al Etihad Credit Bureau (AECB) or any other reputable credit reporting agency.

Check these things in the credit report:

Debt-to-Income (DTI) Ratio

It will show if the renter has enough money for all their expenses plus the amount of rent you will charge them.

Types of Cards and Number of Credit Cards

See how many credit cards a potential tenant has. In the case of multiple credit cards, ask them the reason for keeping so many cards. Individuals with numerous credit cards, particularly those for luxury, such as retail clothing shops, may be habitual overspenders.

Delinquent or On-time Payments

Credit card reports will also inform you of the nature of prospective tenants — whether they pay their bills on time or not. It will indicate they will likely pay your rent on time too.

And if the report shows they fell behind the due date of monthly payments, take it as a red flag. Consider how many times it happened, the amount of money they were delinquent to pay, and the period of delinquency.

Credit Maturity

Some potential tenants may have little to no credit. But you should evaluate how mature their credit history is. Younger people will have a lower credit score because they will be just developing credit. If your tenant is younger, ask them to bring a cosigner who can verify them.

Student Loan Debt

Many college pass-outs have a massive student loan debt that you can see on their credit report and impact their DTI ratio. If your prospect is a student with an outstanding loan debt, consider it as heavily as you would a debt from a credit card.

Yes, students pay their loans over many years but still assess the amount of money the student is paying monthly to get a bird’s eye view of the situation.

Overall Score

Most homeowners prefer a 700 credit score at a minimum because it indicates that the person has a healthy credit history and can be relied on to pay on time.

Validate Their Job and Income

Another significant facet of screening rental candidates is authorizing their employment and income, ascertaining if the person can pay the rent, and whether they have a stable job.

The rule of thumb is the three times rule. If the tenant’s total monthly income is thrice the rent, there is a strong likelihood that they will be able to afford the rent without stress.

But this is not a hard and fast rule. Though it is followed by many landlords, you can consider elevating or reducing this multiple in your case.

As a landlord, you can confirm a tenant’s evidence of income through various ways, including tax returns, paying stubs, or bank statements.

Don’t just believe their word that they work in such and such organization. Make a call to their organization to authenticate their job status and jot down things about their behavior and performance in the workplace.

Experienced landlords will tell you that job security is usually a more precise sign of a quality tenant than income alone.

Analyze Their Renting History

If you are going to rent your apartment in Ajman to someone, you should know how they behaved with their previous landlords. It is one of the workable methods of tenant screening.

Check the addresses of the apartments they lived in past on rent and contact their landlords. You may ask some particular questions to them about their experience with the potential tenant.

Did they pay rent on time?

What amount did they pay in rent?

Did they keep the apartment in good condition and leave it without any serious damage when moving out?

Did fellow apartment residents complain about pets or noise?

Would you choose them as a tenant again?

Meeting the most recent or current landlords will give you the best idea of what a potential tenant is like. Whether they are easy to deal with, fight with people or do they pay rent on time, and whether they take care of the rental property.

However, consider that the landlord may be the one doing the mischief in some cases. An argument may have erupted between the tenant and landlord because the latter doesn't obey the government’s landlord-tenant law. To solve this confusion, you should talk to several landlords if feasible.

We recommend you make it a condition for tenants to bring a reference letter from their previous landlords detailing the duration of their stay at their residence, the amount of rent, and whether they pay it on time.

Ask Screening Queries to the Applicants

Until now, you may have gathered enough evidence supporting or against renting your residence to an applicant. If you have enough proof to ditch an applicant, you don’t need to interview them.

However, if you are doubtful about an applicant’s qualification for tenancy, you should conduct their interview. Read the documents or pieces of evidence with them to allow them to explain something derogatory.

You are a human and might have flaws in your findings that the applicant can review and clear up during the interview.

And you must know about the fair housing regulations that prevent landlords from discriminating between tenants due to religion, race, gender, ethnicity, societal status, or disability.

Understand how you can screen tenants without violating fair housing policies. It involves knowing what questions are appropriate to ask and not rejecting an otherwise qualified applicant.

Bottom Line

To sum it up, tenant screening is important for property owners to ensure that their apartment is inhabited by someone sensible and trustworthy. Bad tenants can harm your property or could make difficulties for you due to their criminal background.

You might think tenant screening is a pretty time-consuming process, but ignoring it can have some serious consequences in the long run. But when you perform detailed assessments, authorize their job and salary, and communicate with their past landlords, you minimize your chances of finding yourself in hot waters.

It's crucial to place clear screening criteria and implement them uniformly for all candidates to dodge prospective discrimination claims.

Appreciate the creator