How Suppliers Drive Progress in Corrugated Board Category

The corrugated boards industry is poised for substantial growth, with a projected compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Several factors are driving this growth, including the increasing demand for sustainable packaging, heightened environmental concerns, a surge in the food and beverage industries, and the global expansion of the e-commerce market. Corrugated boards are emerging as a suitable alternative to plastic packaging, a material contributing to the generation of approximately 300 million tons of global plastic waste each year, nearly matching the weight of the entire global human population, as per United Nations data.

In 2022, the global corrugated board category reached a valuation of USD 134.7 billion. One of the prominent trends in the industry is the proliferation of digitalization, automation, and sustainability. For instance, Swiss-based company Bobst introduced a suite of services and solutions in June 2022, focusing on assisting brand owners and organizations in achieving sustainability and embracing digitization. These trends have led to a significant emphasis on sustainability, digitization, automation, and connectivity within the packaging and printing machinery sector.

Corrugated boards have gained widespread acceptance, particularly in response to the Government of India's call for a ban on plastic-based packaging. Foreign direct investments (FDIs) and local investments are pouring into Asian countries, bolstering market share growth.

The nature of the corrugated board category is characterized by fragmentation, with numerous players in the market. Major industry players are heavily investing in research and development (R&D) to expand their product offerings and fuel category growth. Strategies include launching new products, acquiring companies, increasing investments, entering into contracts, and collaborating with other organizations to extend their global footprint. To thrive in this competitive landscape, category participants are adopting strategies such as local manufacturing to reduce operating costs. For example, UFP Packaging, a division of UFP Industries in the United States, acquired Titan Corrugated and its subsidiary All Boxed Up to expand its market presence.

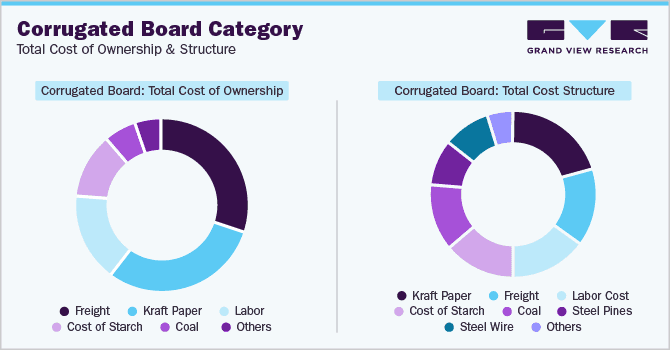

When it comes to the major cost components of corrugated board production, they include kraft paper, corn starch (used for glue), and labor. Various factors can influence the pricing of these raw materials, including import duties, logistics costs, waste paper prices, and fuel costs. Businesses must carefully consider these factors when pricing their products to ensure competitiveness and profitability.

Kraft paper, a primary raw material for corrugated board production, has experienced a significant price surge, doubling in the last two years, with an approximately 65% increase since 2020. Prices increased by almost 25% in the early months of 2022. This surge is attributed to the European Union's ban on the export of waste cuttings, disrupting the supply of cheaper raw materials. The import of materials has been severely impacted by COVID-19 recovery, leading to increased prices of waste papers, fuel, starch, and input costs. Cornstarch prices have risen by about 35%, leading to increased conversion costs, along with higher prices for stitching wires, steel pins, and ink.

Leading sourcing destinations for corrugated boards include China, Vietnam, and India, with China alone having around 13,980 suppliers. China exports approximately USD 158 million worth of Kraft paper to countries like South Korea, Vietnam, Australia, and Malaysia. Major players in China's corrugated board market include Asia Pulp and Paper and UPM Group. In 2022, the Asia-Pacific (APAC) region accounted for over 40% of the market share, driven by urbanization and increased spending power in countries like India and China. In terms of corrugated board sourcing intelligence, the top five preferred countries are China, Vietnam, India, the United States, and the United Kingdom.

Key Companies Profiled

DS Smith, Smurfit Kappa, WestRock Company, Mondi, Packaging Corporation of America, Stora Enso, International Paper, Georgia-Pacific, Oji Holdings Corporation, Port Townsend Paper Company

Appreciate the creator