Health Insurance 101: Everything You Need to Know

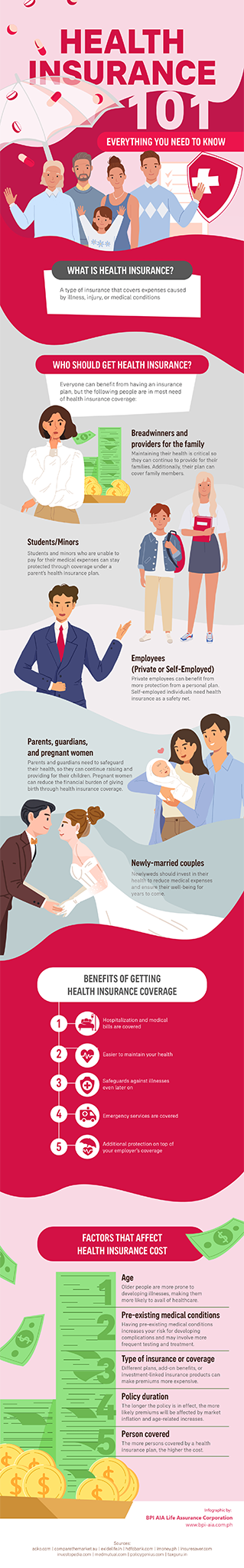

Health insurance is easily one of the most critical investments to have. This type of insurance covers expenses that arise from an illness, an injury, or other medical concerns, providing security if any of these should occur. Sadly, many have the wrong impression that health insurance is a luxury rather than a safety net.

Why get health insurance?

Nearly anyone can benefit from having health insurance coverage—from breadwinners and parents to students, minors, and even freelancers. While the upfront cost of a plan can be daunting, spending on long-term healthcare can be very costly. Hospital bills from an unexpected medical emergency can easily put pressure on or even jeopardize your finances.

A health insurance plan can help cover your healthcare costs, allowing you to focus on your health without breaking the bank. In a medical emergency, this allows you to receive urgent, life-saving care when needed and deal with the costs once you’ve recovered.

Additionally, the state of your health can affect other aspects of your life. Being sick or injured can lead to lost income and further financial problems for freelancers and those providing for their families. For children, illnesses and injuries are unavoidable, so getting treatment is crucial to ensure their continued growth and development.

Health insurance coverage also makes accessing medical care and services to help maintain your health easier. Depending on the type of plan available to you, you may even be able to avail of certain tests, procedures, and consultations without paying a single cent. Since early detection and treatment are key in preventing certain diseases, investing in health insurance gives you a better chance at living a better, longer life.

How much does health insurance cost?

Health insurance plans will often differ between providers, but several common factors determine the plan’s overall cost.

The benefits and plan coverage play key roles in determining how much premium you are expected to pay—the more expensive the premium, the less out-of-pocket costs incurred. Adding riders and optional benefits to your plan will also cause your premiums to increase.

Other factors include the insured’s age, pre-existing medical conditions, duration of coverage, and the number of people covered by a plan.

Your health is important, making it critical to secure it as soon as possible. Keep reading the infographic below for everything you need about health insurance.

Appreciate the creator